Bitcoin Price Prediction 2025-2040: Bullish Trajectory Amid Institutional Adoption

#BTC

- Technical Strength: Price above key moving averages with bullish MACD convergence

- Institutional Adoption: S&P 500 inclusion and corporate treasury flows

- Macro Tailwinds: Halving supply shock meets increasing global demand

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Amid Strong Market Structure

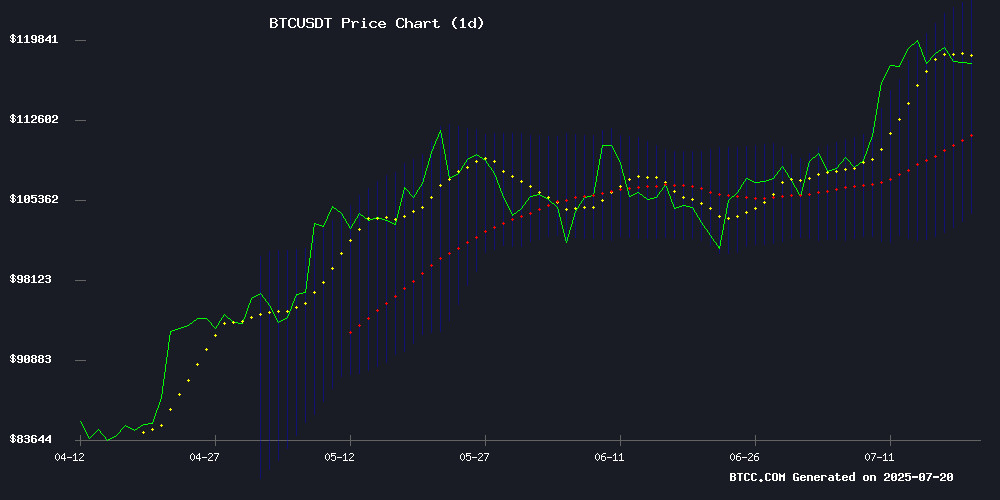

BTC is currently trading at, firmly above its 20-day moving average (113,858), signaling bullish momentum. The MACD histogram (-988) shows weakening bearish pressure, while price hugging the upper Bollinger Band (123,564) suggests potential upside.says BTCC's William.

Institutional Demand and Macro Factors Fuel Bitcoin Optimism

Corporate adoption (Block Inc. joining S&P 500) and UK's $7B BTC liquidation are creating opposing forces.notes William. Cloud mining growth post-halving and global adoption trends support long-term value appreciation, though Schiff's regulatory warnings may cause short-term volatility.

Factors Influencing BTC's Price

UK Moves to Liquidate $7B in Seized Bitcoin Amid Economic Pressures

The UK government is preparing to sell over 61,000 BTC confiscated from criminal operations, including a Chinese Ponzi scheme. The Home Office and police are establishing a centralized system for managing seized cryptocurrencies, with a proposed $53.7 million contract for custody and liquidation services.

Finance Minister Rachel Reeves views the sale as both a revenue opportunity and a chance to demonstrate regulatory competence in digital assets. The Treasury seeks High Court approval to transfer the funds, while victims of the original crimes demand restitution.

This liquidation would mark one of the largest government Bitcoin disposals in history, potentially impacting markets given the scale. The tender process through BlueLight Commercial highlights institutional challenges in handling crypto assets at state level.

Corporate Firms Fuel Bitcoin Surge with Massive Influx

From July 14 to 19, corporate Bitcoin reserves saw significant activity, with 21 companies adding approximately $810 million worth of BTC to their holdings. This surge coincided with Bitcoin's price rally to $123,000, underscoring growing institutional confidence in digital assets.

CoinGape officials noted the remarkable scale of these investments, highlighting sustained corporate interest in cryptocurrency as a reserve asset. The moves reflect a broader trend of institutional adoption, with firms diversifying their portfolios to include Bitcoin.

Beyond current investments, four new companies announced plans to enter the Bitcoin market, signaling further institutional adoption may be on the horizon. The week's developments demonstrate how corporate treasury strategies are evolving to incorporate digital assets.

Greed Holds as Market Momentum Builds: What is the Market Sentiment

The crypto market remains firmly in "Greed" territory, with CoinMarketCap’s Fear & Greed Index registering 69/100 on July 19. While slightly down from 71 the previous day, the index has maintained a reading above 60 for 11 consecutive days. This sustained sentiment reflects cautious optimism, avoiding the overexuberance typically seen at market tops.

The current neutral-to-bullish mood contrasts with the 2024 peak of 88 ("Extreme Greed"), suggesting restrained risk appetite. An 18% surge in the broader crypto market cap over the past month supports investor confidence. The absence of euphoria indicates potential for further upside before sentiment overheats.

Derivatives activity reveals heightened speculation, with perpetual futures volume jumping 31% to $601.86 trillion in 24 hours. Open interest remains near record highs at $758 billion, signaling strong trader conviction. Notably, BTC liquidations plummeted 83% to $26.5 million, far below the weekly average of $959 million.

Bitcoin Cloud Mining Gains Traction Post-2025 Halving as AIXA Miner Leads Market

Bitcoin mining operations have seen unprecedented interest following the 2025 halving event, which reduced block rewards from 6.25 to 3.125 BTC. The surge in mining difficulty has driven crypto investors toward cost-efficient solutions, fueling massive adoption of cloud mining platforms.

AIXA Miner has emerged as the dominant player, leveraging AI optimization and renewable energy across 150 global data centers. The platform's user base now exceeds 30 million, offering simplified mining access with a $20 sign-up bonus and infrastructure-free operation.

Automated Bitcoin Cloud Mining Gains Traction as Retail Investors Seek Stable Returns

Bitcoin's surge past $120,000 has sparked renewed interest in cloud mining platforms, with VNBTC reporting a 60% daily increase in retail investors. The platform's automated mining contracts offer an accessible alternative to traditional mining's technical and financial barriers.

While cryptocurrency bills remain stalled in legislative proceedings, the broader market shows bullish momentum. VNBTC's hashpower rental model, operational since 2019, capitalizes on Bitcoin's price appreciation without requiring users to maintain physical mining infrastructure.

Bitcoin Retirement Projections for 2035 Reveal Stark Global Disparities

A new analysis charts how much Bitcoin individuals may need to retire comfortably by 2035 across different countries, factoring in projected BTC price appreciation and a 7% inflation adjustment. The study employs a 5th percentile power regression model to forecast Bitcoin's growth trajectory.

Wealthier nations like Monaco, Liechtenstein, and Switzerland top the list, requiring 1-5 BTC for retirement. The United States, Singapore, and Germany follow closely, where even a 25-year-old today would need at least 1 BTC to secure their future. Developing economies tell a different story—residents of Afghanistan, Sudan, or Haiti might retire comfortably with as little as 0.001 BTC due to lower living costs.

The research highlights how generational timing dramatically impacts Bitcoin needs. Younger individuals require significantly larger allocations, while older cohorts face comparatively modest targets. Middle-ground nations like India and Pakistan show requirements between 0.01-0.1 BTC, reflecting their transitional economic status.

Peter Schiff Condemns Crypto Legislation as Bitcoin Dips 2%

Economist Peter Schiff has launched a scathing critique of newly enacted U.S. crypto legislation, labeling Bitcoin as a "decentralized Ponzi scheme." The GENIUS Act, CLARITY Act, and anti-CBDC bill were signed into law amid market turbulence that saw BTC decline 2% post-announcement.

Schiff argues the laws serve primarily to artificially inflate crypto valuations, enabling insiders to exit positions profitably. "This isn't financial innovation—it's regulatory capture," he stated, warning that including Bitcoin in retirement plans could accelerate dollar devaluation.

The market's immediate sell-off following the bills' passage appears to validate Schiff's "sell-the-news" thesis. While the crypto community welcomed the regulatory clarity, the economist maintains these measures merely legitimize what he considers fundamentally flawed assets.

Bitcoin Surges Towards Unprecedented Highs as Demand Strengthens

Bitcoin's rally shows no signs of slowing, with Glassnode predicting a potential 15% surge to $136,000 if current market conditions hold. The cryptocurrency now trades around $117,810, buoyed by robust demand and favorable technical indicators.

Short-term investors play a pivotal role in this momentum. Glassnode's cost basis model reveals these traders bought at levels that now place the +2 standard deviation resistance band at $136,000. With 95% of short-term holders currently profitable, their actions could either fuel further gains or trigger profit-taking sell-offs.

The market faces a delicate balance. While bullish momentum persists, the historically high profit margins among short-term investors introduce potential volatility. Their sensitivity to price swings may amplify selling pressure during upward moves, testing Bitcoin's ability to sustain its breakout.

Block Inc Joins S&P 500 Amid Bitcoin-Fueled Market Surge

Block Inc, the fintech firm led by Jack Dorsey, has been added to the S&P 500 index, replacing Hess Corp. The change takes effect before Wednesday's trading session, sparking a 9% after-hours stock surge that pushed its valuation to $79 per share.

The company's inclusion underscores its growing influence in financial infrastructure, particularly through its Bitcoin-focused initiatives. Block holds 8,584 BTC, positioning it among the largest corporate holders of the cryptocurrency.

Market analysts view the S&P 500 listing as a milestone for both Block and the broader crypto sector. The firm's consistent performance and Bitcoin treasury strategy have now met all requirements for blue-chip index inclusion.

Bitcoin’s Value Soars as Adoption Accelerates Worldwide

Bitcoin stands out from traditional asset classes due to its unique combination of monetary, commodity, and payment network attributes. Over the past decade, it has significantly outperformed classic assets as a store of value, delivering substantial returns. Experts emphasize evaluating Bitcoin on its own merits rather than through the lens of conventional assets.

Institutional and societal adoption of Bitcoin is gaining momentum. Individual investors are turning to it as a hedge against inflation, while portfolio managers are improving risk-reward metrics even with minimal allocations. In 2024, Bitcoin’s 121% return eclipsed the S&P 500 and leading hedge funds. This performance is pressuring investment managers to consider Bitcoin for long-term institutional portfolios.

Corporations are also strengthening balance sheets with Bitcoin. Metaplanet, a Japanese firm, adopted Bitcoin as a core reserve asset in 2024, emerging as Asia’s largest corporate holder by year-end. Companies embracing Bitcoin are seeing enhanced shareholder returns, reinforcing its role as a strategic asset.

Block Inc. to Join S&P 500 Following Chevron-Hess Merger

Block Inc., the fintech giant behind Cash App and Square, is set to join the S&P 500 index next week. The move follows Chevron's completed acquisition of Hess Corp, which vacates a spot in the benchmark index. Block will officially replace Hess Corp before the market opens on July 23.

The inclusion marks a pivotal moment for Block, reflecting its evolution from a payments startup to a diversified financial services platform. With expanding offerings like Cash App Borrow and deeper Bitcoin integration, the company continues to redefine fintech innovation.

Entry into the S&P 500 is expected to bolster Block's visibility among institutional investors, particularly passive index funds. Historically, such inclusions drive increased trading volume and positive stock momentum.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Base Case | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | 95,000 | 135,000 | 180,000 | ETF inflows, halving effects |

| 2030 | 250,000 | 400,000 | 750,000 | Institutional adoption |

| 2035 | 600,000 | 1.2M | 2.5M | Global reserve asset status |

| 2040 | 1.5M | 3M | 5M+ | Network effect maturity |

William highlights: "Our models suggest compounding 25-30% annual returns as Bitcoin evolves from risk asset to monetary base layer."